Compartir

Lea a continuación

The "Report on Regional Economies April-June 2022", prepared by Banco de México, states that in recent years different phenomena have called into question the current global production system of internationally fragmented production chains.

Companies integrated into global chains have had greater benefits, since the relocation of companies is more common in sectors that have shown a greater tendency to fragment production.

Photo: Getty Images

The above – the report explains– has raised the possibility that in the coming years a reconfiguration of these chains may be observed through the relocation of production to places closer to the country of consumption, which could lead to the strengthening of regional production chains.

In the case of Mexico, the geographic proximity to the United States and the existence of the USMCA have reduced institutional and monetary barriers to trade and have facilitated the transit of products between these two countries.

"As a consequence, Mexico is a natural candidate for the relocation of companies that supply goods to the U.S. market," the document points out.

On this matter, the Monthly Survey of Regional Economic Activity (EMAER), also conducted by Banco de México, details that there are indications of the trend of bringing the production of global companies closer to the United States and its impact on Mexican production.

"The benefits have been heterogeneous among regions and sectors, but the northern region of Mexico and the manufacturing sector integrated in global value chains have been the most favored," the information indicates.

Alejandrina Salcedo, director of analysis on prices, regional economy, and information at Banco de México, commented that several contacted companies assign a high probability that this process will continue.

"If it does, it will probably happen gradually and will depend on the expectation that the benefits of the relocation will outweigh its costs, which are high in monetary terms, and on the complexity of forming productive networks," she said.

Regarding the latter, Banco de México’s report specifies that nearshoring involves not only the construction of factories, but also the establishment of new links with suppliers, which can be difficult and even unfeasible due to the specialized requirements and high-quality standards.

Impact on the supply chain

The EMAER survey asked company representatives whether their production, sales or investment had increased in the last twelve months as a result of nearshoring.

Among the results, 16% of the companies with more than 100 workers nationwide have benefited in some way from this phenomenon in the last twelve months, either due to greater Foreign Direct Investment or due to greater demand from companies established in the United States, from companies that have moved their operations to Mexico or from other Mexican companies that have benefited from nearshoring.

Likewise, the information indicates that companies integrated into global chains have had greater benefits, since the relocation of companies occurs to a greater extent in sectors that until now have shown a greater tendency to productive fragmentation.

In addition, among exporting manufacturing companies, the proportion of those that have benefited has been greater compared to non-exporters, although both groups were positively impacted.

"The latter emphasizes that the benefits of productive integration are not exclusive to the export sector, but that this phenomenon opens the opportunity for the development of local supply chains that allow domestic companies to insert themselves into global chains and thus promote positive economic spillovers to the rest of the economy," the information points out.

Specifically, according to the report, 6.9% of the companies surveyed nationwide observed greater demand from U.S. based companies that previously obtained their products or services from companies in other countries, with a higher proportion of companies benefiting in the north compared to the rest of the regions.

"This could be explained by the geographic proximity of that region to the United States and by the composition of its production," the information indicates.

In addition, 4.6% of the companies perceived a greater demand for their goods or services by foreign companies that have moved their operations to Mexico or by new foreign companies that have established themselves in the country, likewise with a greater proportion of companies benefiting in the north.

On the other hand, 6.6% of the companies have faced greater demand from other companies established in Mexico, which in turn have benefited from greater demand from foreign companies, with a greater proportion of companies benefiting in the southern region.

Additionally, 3.4% of the companies reported having received greater foreign direct investment, with a higher proportion of companies impacted in the north.

Nearshoring is reflected in Mexico

According to a study by the Inter-American Development Bank (IDB), Latin America and the Caribbean could increase their exports annually by US$78 billion in the short and medium term thanks to nearshoring.

Mexico would be the Latin American country with the greatest opportunities in this regard, as it could add 35.3 billion dollars annually, just considering the export of goods.

"Latin America is currently experiencing a unique opportunity to attract investment and in no country is this opportunity greater than in Mexico due to its geographic location, its membership in the USMCA, its abundant human talent and productive complexity, as well as its growing articulation in global value chains," said IDB Vice President for Countries, Richard Martínez.

He explained that the idea is to contribute to the attraction of investments and the development of industrial parks and logistics platforms, strengthen the insertion of SMEs in global value chains, support the development of talent and territorial planning, and contribute to closing important social and economic gaps.

"Integrating the region into global value chains will help close social and productive gaps, trigger investments and develop new opportunities in areas such as manufacturing," the IDB document states.

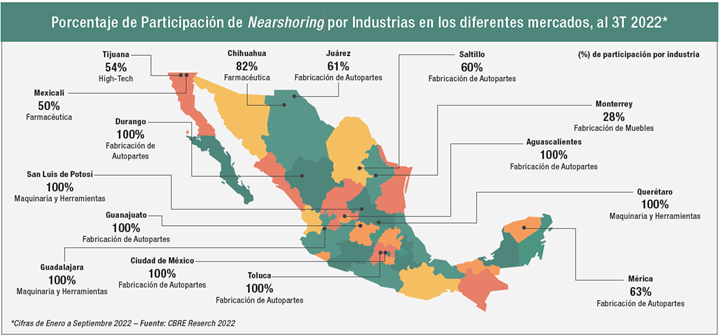

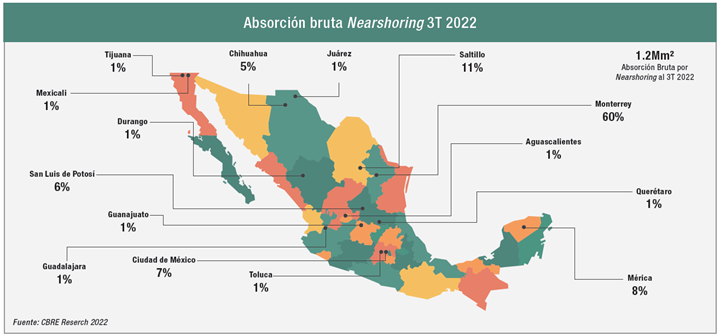

In this regard, according to Francisco Muñoz, Executive Vice President of Industrial and Logistics at CBRE, as of the third quarter of 2022, 1,200,000 m² of demand for nearshoring was reached; this represented almost double the annual figure with which 2021 closed.

"In the annual demand we see that the northeast of the country was the dominant region. The share of nearshoring over total industrial demand went from 14% in 2021 to 26% at the close of the third quarter of 2022," Muñoz indicated.

The executive explained that the Monterrey and Saltillo markets accounted for 61% of nearshoring demand nationwide, while auto parts manufacturing dominated nearshoring industrial space transaction activity in most of the center-north markets of the country.

"During 2022, auto parts manufacturing accounted closely 40% of the nearshoring demand, while furniture, machinery and home appliance manufacturing maintains a strong trend of participation," Muñoz added.

The executive explained that, between January and September 2022, investments from China accounted for 40% of the nearshoring demand, a figure consistent with the demand recorded in the last four years from that country.

Monterrey and El Bajío

"Monterrey's proximity to the U.S. border, along with its skilled labor, infrastructure and strong supplier base, make it an extremely advantageous location for occupiers and investors. An increase in investment and development has made the city one of Mexico's top industrial markets," said Ramon Flores, Executive Vice President of CBRE Northeast.

The firm reports that, at the end of the third quarter of the year, the manufacturing sector continues to lead industrial demand in Monterrey and its metropolitan area, with 70% of the total leased space. It is followed in second and third place by the automotive and high-tech sectors, with 14% and 12%, respectively.

China continues to be the main country of origin of new investments in Monterrey, with 46% of gross absorption. Investments from Germany are in second place with 22%, leaving the United States in third place with 19%.

In the case of El Bajío, CBRE reported that from January to September 2022, this region registered a net absorption of 232,000 sq m, similar to the figure achieved in the same period of 2021.

The gross absorption reached 322,000 sq m, 16% lower than in 3Q 2021. It also noted that the vacancy rate continues to decrease and closed the quarter at 4.3%, one of the lowest since 2018.

The company noted that a reactivation of speculative projects was achieved in the second half of 2022, mainly in Querétaro.

"The trading activity increased at the end of last year due to companies installed in the region announcing expansions," indicated Rodrigo Folgueras, CBRE Director of the El Bajío region.

The firm refers that El Bajio has been characterized in recent years by the expansion of companies installed in the region, with Guanajuato and Querétaro leading the industrial demand.

"As of the third quarter of 2022, both entities accounted for more than 80% of net absorption, a figure that represents close to 200,000 m², mainly from light manufacturing companies," the information specifies.

In the case of San Luis Potosí, it has been characterized by tenants seeking to purchase industrial land for the development of their buildings, and Aguascalientes by the renewal of existing leases.

"It is expected that the nearshoring that has attracted investments in the industrial markets of the U.S.-Mexico border will also reach the El Bajío region, mainly companies in the automotive sector, which is an important cluster in the region, in San Luis Potosí and Guanajuato," Folgueras explained.

He added that Querétaro is also expected to continue with logistic demand and with the diversification of the light manufacturing industry as it has been doing so far.

Direct Foreign Investment

In 2021, Mexico received 2% of total Foreign Direct Investment (FDI) flows, which allowed it to rank 10th on a global scale.

In the case of Mexico, from January to September 2022, FDI of 32,147.4 million dollars was recorded (figures available at the time of writing this report). This figure was 29.5% higher than the preliminary figure for the same period in 2021 (24,831.7 million dollars).

In the indicated period, the manufacturing sector received 36.3 % of the total FDI; of this percentage, the Transportation equipment manufacturing subsector received 37.2 %; the Basic metal industries 14.7 %; the Chemical industry 10.4 %; the Computer equipment manufacturing 7.5 %; the Plastics and rubber industry 6.9 %; the Energy equipment manufacturing 6.8 % and the Rest of the subsectors 16.5 %.

Likewise, the main countries of origin of FDI for this subsector were the United States with US$84.2 million, Japan with US$18.7 million and Spain (confidential data).

Benefits for the Automotive Industry

According to Manuel Montoya, CEO of the Nuevo Leon Automotive Cluster (CLAUT) and President of the National Network of Automotive Industry Clusters, the industry has undergone interesting and complex changes almost two years after the start of the USMCA.

"Transnationals are moving the production they were doing, especially in China and in some cases in Japan and Germany and are bringing it to the region. For example, they are looking for someone to do machining or stamping in Mexico," said Montoya.

On this matter, the executive commented that the process of dealing with new suppliers normally takes six to ten months, from the initial contact to the closing of the deal, but this period is being shortened.

"Precisely, a transnational company came to the cluster last year -although it is not from the automotive sector- because it was looking for similar suppliers. It was bringing 600 million dollars’ worth of parts that it made in China and is now looking to locate them in Mexico," said Montoya.

He added that the company continues its search, although it has already given business to some suppliers in the region: "This is the type of nearshoring we are seeing: to stop producing components and subcomponents in Asia, and also some in Europe, to do it here".

Montoya commented on other examples of companies in the region that have benefited due to US and nearshoring.

"We have the case of a plastic injection molding company that in 2020 had a drop in sales of 13 % compared to 2019, but in 2021 they increased 15 % compared to 2019. With $9 million from new clients and $9 million from clients it already had, it estimates that this year it will grow up to 30% over 2019," the executive indicated.

He added that another example is a foaming company for the automotive industry: "In two years it has achieved 2.5 million dollars with five new customers. Another stamping company with five new customers has grown 20% with respect to 2019 sales."

And finally, he referred that a machining company has achieved in the last two years (after the USMCA), nine new customers that have represented 1 million dollars in sales.

"This represented an increase of 42% in 2021 with respect to 2020, and they expect an increase of 65% in 2022 with respect to 2021," said Montoya.

He added that all these cases are the effect of the entry into force of the USMCA rules of origin, which force transnationals to look for suppliers in Mexico.

Finally, Montoya said that although fewer cars are being produced in the region, more parts per vehicle are being made in Mexico.

Benefits for the Appliances Industry

Baldwin Britton, Vice President of the appliances Cluster (CLELAC) and Global Director of Plastiexports, said the pandemic damaged many supply chains, which put Mexico as an epicenter for manufacturing with the arrival of new investment.

"The appliance sector is no exception. The work the government has done to bring in new investment has opened up opportunities for local, regional and national supply chains," said Britton.

The executive added that companies require national and regional suppliers to be able to supply their chains: "We have very important investments that have been announced in recent months.

In this regard, Britton commented that companies such as Bosch have recently invested in Nuevo León: "Hisense is a new investment in the state; another company is Dometic, which set up a plant two years ago and is now relocating its supply chain.

The executive commented that new important investments are planned for the region: "The objective of relocating their value chains to Mexico is to mitigate freight costs, the cost of containers coming from Asia and other inputs.

In this regard, Carlos González indicated that the opportunity for Mexican SMEs lies in how to integrate into supply chains.

"We understand that some elements will facilitate the integration of Mexican SMEs, such as the certifications that this industry requests to engage in conversations between suppliers and customers, as well as the ability to make manufacturing more flexible and approach work from a much more agile and automated perspective," he said.

He added that other elements include improving their logistics and delivery processes and streamlining processes not only in manufacturing, but in project management.

"Also, the delivery of quotations and everything that involves the commercial relationship and communication with customers," Gonzalez said.

Benefits for the Aerospace Industry

"Mexico's technical and engineering capacity makes the country an attractive place to invest, especially at a time when large manufacturers are looking to relocate their plants to be close to the United States," said René Espinosa, president of the Mexican Federation of the Aerospace Industry (FEMIA).

The executive highlighted that several suppliers are looking for new places to locate and that the Mexican territory is a fundamental pole.

"Crises such as the one we are facing in the global supply chain as a result of COVID-19 and the trade confrontation between China and the United States are forcing large manufacturers to undertake geographic relocation tactics to nearby places such as Mexico," he explained.

Espinosa said that Mexico is today a relevant and strategic player in the aerospace supply chain for North America and Europe.

"We cannot speak of growth and development of the aerospace industry if we do not carry out projects that stimulate the progress of national companies, as well as the training of talent based on the development trends of new technologies and cutting-edge materials," said Espinosa.

In this regard, Luis Lizcano, executive president of FEMIA, detailed that the geopolitical situation poses an important opportunity for Mexico as an industrial sector.

"We need to be prepared to take advantage of the opportunities that arise. We need to do our homework inwards, in other words, we must be prepared so that when the contracts and the possibilities of quoting come along, we can do so successfully," he explained.

Nearshoring: expectations for the coming years

According to the Monthly Survey of Regional Economic Activity, 58.3% of the companies surveyed reported a positive probability of observing an increase in production, sales or investment in Mexico as a result of nearshoring in the next three years.

Meanwhile, 74.4% of the companies surveyed reported a positive probability of observing such an increase in other companies in the same sector, and 79.8 % in companies in other sectors of activity.

On the other hand, the survey also asked about the characteristics of Mexico that currently make it attractive as a destination for the transfer of production of companies that supply the U.S. market.

Among the factors considered most important are the following:

- Proximity to the United States

- Wage levels

- Existence of a skilled labor force

- Infrastructure

- Proportion

- Tax conditions or incentive schemes

- Rule of law

In addition to these factors, some companies mentioned that Mexico is attractive because state governments and industrial chambers take actions to attract foreign companies and facilitate their installation, as well as the country's political and economic stability and the consolidation of supplier clusters.

Contenido relacionado

Mata Automotive inaugura planta en Aguascalientes

Mata fabricará alrededor de dos millones de piezas al año para vehículos eléctricos de marcas como Tesla, Audi, Dodge, GM, entre otras.

Leer MásIndustria automotriz inicia 2024 con crecimiento

En el primer mes de 2024 la producción de la industria automotriz de México creció 9.56 %, mientras que la exportación creció 6.82 %.

Leer MásClústeres industriales en México: perspectivas regionales en 2023

Altamente integrada en cadenas regionales y globales de valor, la industria manufacturera mexicana ha tenido importantes cambios en los últimos años y generado oportunidades clave para las diferentes regiones industriales del país.

Leer MásMéxico: perspectivas de crecimiento para la industria de autopartes

En 2023, la industria de autopartes en México prevé un crecimiento del 10.45 %, con un valor de producción de USD 115,802 millones, esto pese a desafíos como la huelga de UAW en EE. UU. El nearshoring ha jugado un papel clave.

Leer MásLea a continuación

La tecnología: recurso primordial para ser proveedor de la industria aeroespacial en México

Indumet Aerospace es una de las empresas pioneras en México como Tier 1 de la industria aeroespacial. La inversión en la última tecnología para el mecanizado en 5 ejes ha sido una de las claves del éxito que la ha llevado a ser proveedora de reconocidos OEM.

Leer MásPor qué los talleres en México usan tornos tipo suizo

En México, el uso de tornos tipo suizo ha venido en crecimiento. Si bien empezó con aplicaciones dedicadas a la industria de la joyería y médica, ahora se utilizan para diversas aplicaciones en las industrias automotriz, electrónica, aeroespacial y de petróleo y gas.

Leer MásSistema de sujeción permite a un taller alcanzar las tolerancias requeridas

Este taller de Monterrey, dedicado a la manufactura de ejes para motorreductores, no conseguía alcanzar las tolerancias exigidas por su cliente. El uso de un collet chuck le permitió lograr las dimensiones requeridas y reducir los tiempos del proceso en 54 %.

Leer Más